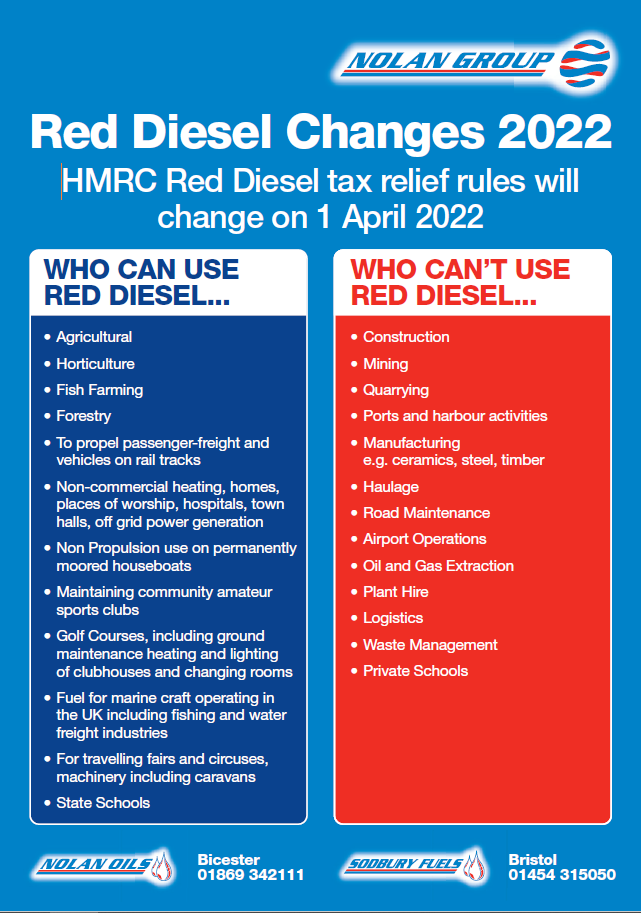

The UK Government announced that from the 1st April 2022 the entitlement for most sectors to use red diesel will cease. This means that any business operating outside of these sectors must use fuel that is taxed at the standard rate for white diesel.

From 1st April 2022, red diesel may be used only for the following purposes:

- vehicles and machinery used in agriculture, horticulture, fish farming and forestry,

- propelling passenger, freight or maintenance vehicle designed to run on rail tracks,

- heating and electricity generation in non-commercial premises,

- maintaining community amateur sports clubs and golf courses,

- fuel for marine craft refuelling and operating in the UK, except for private pleasure craft propulsion in Northern Ireland,

- powering the machinery (inc. caravans) of travelling fairs and circuses.

Check here to see the full list of qualifying purposes.

For all other purposes, red diesel cannot be used after 1st April 2022, including:

- Airport operations

- Commercial heating

- Haulage (inc. refrigeration units)

- Leisure

- Logistics

- Manufacturing

- Mining and quarrying

- Oil and gas extraction

- Ports

- Road maintenance

- Waste management

- Download Information Sheet

- HMRC Interim Guidance – Red Diesel Entitlement (003)

- Red diesel declaration form

- Prepare for the changes

Current users of red diesel in the affected industrial / commercial sectors or applications will not be able purchase or use red diesel from 1st April 2022. You will need to switch to an alternative fuel and ensure no trace of red diesel remains in your tank and supply lines by that deadline.

Why is the Government introducing this change?

Approximately 15% of all diesel used in the UK is Red diesel and produces nearly 14 million tonnes of CO2 a year.

The Government believes that this change will mean that many industries will need to use white diesel, that is taxed at the standard rate, and that this will encourages businesses to use alternative fuels such as HVO Fuel (Hydrotreated Vegetable Oil Fuel) to help reduce environmental impact. Beware, there are both white and red version of HVO fuels too!

Opting to switch to white diesel will likely be cheaper than HVO, but by switching to white HVO you can also reduce your emissions by up to 90%.

What do affected users need to do?

Check the Government guidance to check how this change might affect your user of Red Diesel.

If you are going to be affected, you need to prepare in good time by:

- Plan what alternative fuel you’ll replace your red diesel with

- Run down any red diesel stock before 1st April 2022 (there will be no grace period)

- Thoroughly clean your red diesel tank – you’ll need to flush out the tank and supply lines until no trace of marked rebated fuel remains.

- Keep all purchase / delivery documentation so that you can prove you haven’t purchased red diesel after, or close to, the deadline.

Penalties for non-compliance:

- If storage tanks or supply lines, vehicles or machinery are found with red diesel marker after 1st April 2022, they and any fuel can be seized by Her Majesty’s Revenue and Customs (HMRC).

- Users in sectors / applications that are no longer eligible for Red diesel will be liable for fines if any trace of Red Diesel is found.

For more information about the red diesel reforms, visit the Government guidance here.